A Trust = Your Kingdom Defined

A TITAN NEEDS a TRUST STRATEGY

YOUR TITAN TRUST STRATEGY IS YOUR FORTRESS OF SOVEREIGNTY!

ANYONE CAN SET UP A TRUST.

but If you are not in control of the KEEP,

you are not the King or Queen of the Kingdom!

THE #1 MISTAKE FREEDOM SEEKERS KEEP MAKING:

When freedom seekers yearn for sovereignty, they often turn to free online sources hoping to navigate the lies, government gas-lighting and legalese stitched together from TikTok videos, X posts and anonymous sources hiding their identity or from arrogant "gurus" who don't give all the details you need to execute their "solution"!

But diving into these free strategies or scattered advice leads to a maze of incomplete information, leaving you searching for clarity and vulnerable.

And you already know—a soul seeking clarity thrives on truth, not confusion!

Or worse! Mistake #2...

When you don’t find the freedom you seek in hopes for a path to sovereignty, you might invest in costly guru-led schemes like:

- "Express" or "Off Shore" trusts

- Secured Party Creditor

- UCC filings

- "928" forms filed in a "land" recording website

That’s just a pile of worthless paperwork that doesn't address the REAL ISSUE!

THE Cestui Que Vie Act 1666

Presumption of death for absent individuals:

This Act allows for the presumption of death for individuals who have been absent for seven years. This presumption enables the reversioner (THE STATE) to take possession of the Estate.

Right to reclaim and receive damages upon reappearance:

If the presumed dead individual later returns and proves they are alive, they have the right to reclaim their land and recover damages (including interest) for the profits the reversioner enjoyed while the individual was presumed dead.

“If the supposed dead man proves to be alive, then the Title is revested. ”

[https:// www.legislation.gov.uk/aep/Cha2/18-19/11 ].

YOUR BIRTH CERTIFICATE IS A CERTIFICATE OF TITLE TO YOUR ESTATE

This certificate of title creates an “Estate In Your Name” and this Estate creates the value (YOUR LABOR & CREATIVITY) that supports the Fiat Currency - a.k.a the Federal Reserve Note.

Your Birth Certificate is "Bonded".

(THEY GIVE YOU SILENT NOTICE BY PUTTING IT ON "BOND PAPER")

YOU ARE THE VALUE!

Because you are the value, the U.S. Department of State will Apostille or Authenticate your birth certificate to prove that your estate is entitled to “Full Faith and credit” JUST LIKE A BANK!

Your Estate, which is sometimes written as your given name in ALL CAPS, is an

- “ens Legis" -

and a PUBLIC COMMERCIAL TRUST, where you, the living soul, are the Cestui Que Beneficiary.

As the beneficiary you access the value of your Trust every time you sign a "loan" or set up an account (e.g. utilities) using your SSN.

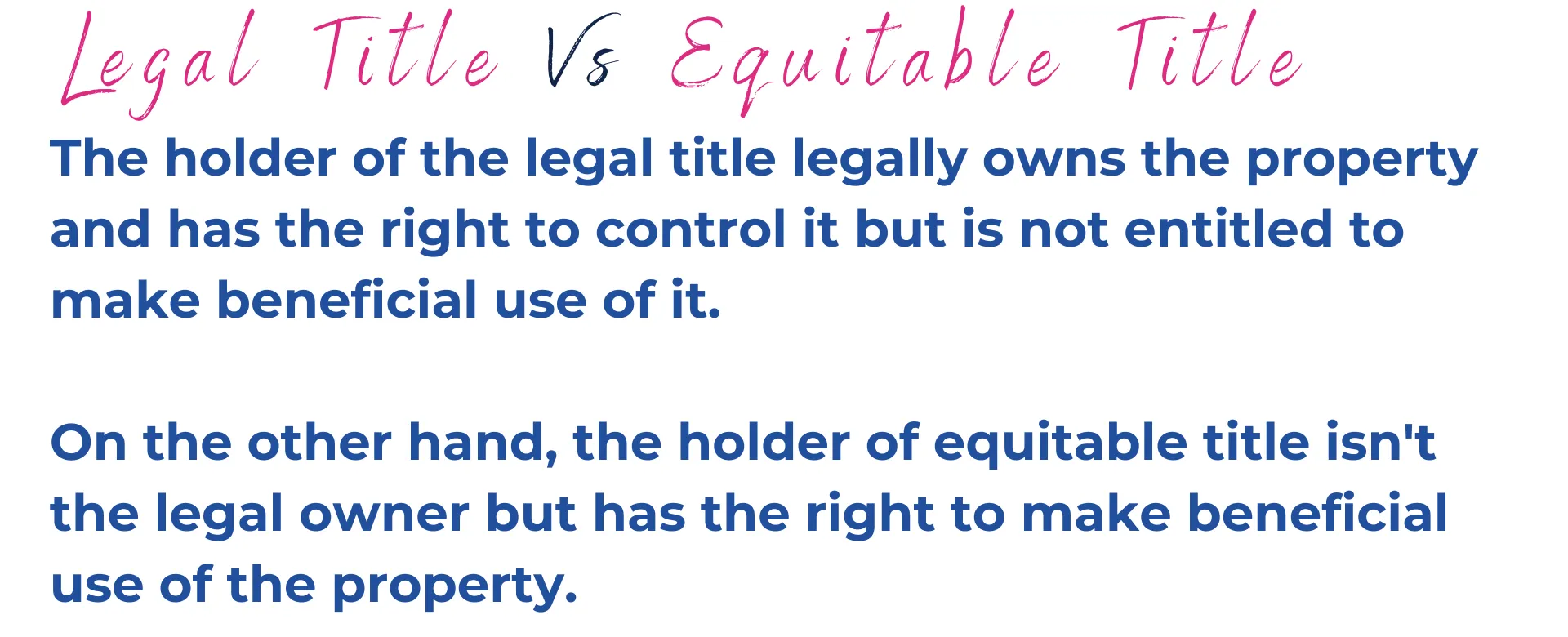

The STATE holds the Legal Title (as "Acting" Trustee) to your estate trust, taxing you — for the “privilege” of managing it for you.

&

You hold equitable title (as beneficiary/"infant"/"decedent") so you can use it to operate in commerce and do things like open a bank account.

It's SHARED TITLE

The IRS secret manual revealed: “An infant is a decedent of an estate or grantor… that has yet to receive a Social Security Number.” (IRM 21.7.13.3.2.2(2))

Why does the IRS hide this section of their manual from the public?

Because, it exposes that after your Birth Certificate is issued to create your estate trust but before you get a SSN, they label you an “infant” and/or “decedent.”

Infants and the dead are unable to manage their own affairs so the STATE is able to retain the claim to the legal title of your estate.

Then they never tell you that all you need to do is prove that you are of age and have the capacity to manage your own estate to gain FULL TITLE.

“The rights of the individual are not derived from governmental agencies, either municipal, state, or federal, or even from the Constitution. They exist inherently in every man, by endowment of the Creator, and are merely reaffirmed in the Constitution, and restricted only to the extent that they have been voluntarily surrendered by the citizenship to the agencies of government. The people's rights are not derived from the government, but the government's authority comes from the people. The Constitution but states again these rights already existing, and when legislative encroachment by the nation, state, or municipality invade these original and permanent rights, it is the duty of the courts to so declare, and to afford the necessary relief.”

— City of Dallas, et al. vs. Mitchell, 245 S. W. 944, 945-46 (1922).

Introducing...

The Step-by-Step Blueprint for Forging a powerful TRUST strategy to protect YOU AND YOUR LOVED ONES. Reclaim Your Divine Birthright and dEFEND Your Creator-Given Freedom!

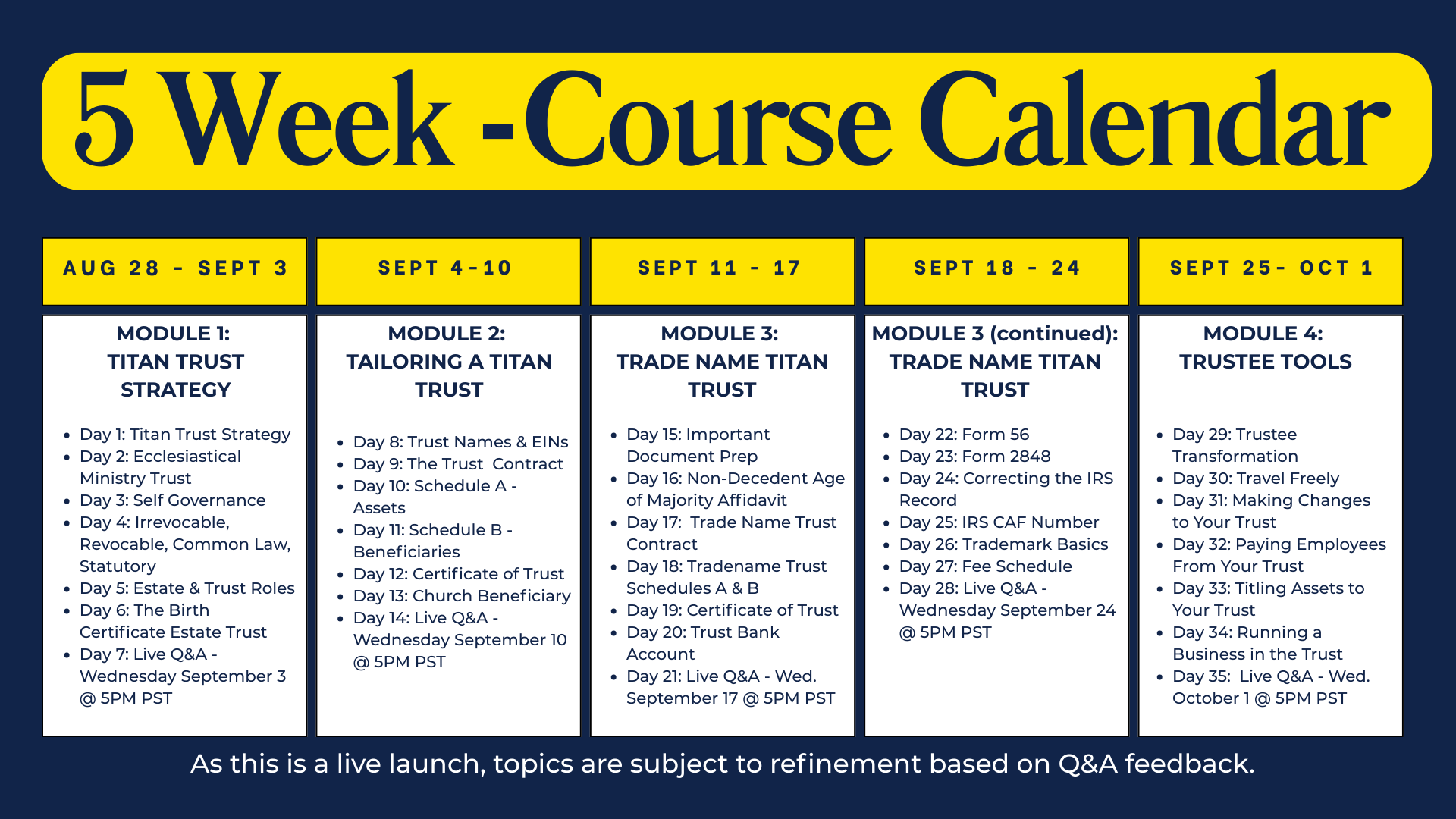

How the Titan Trust 5-Week Course Is Delivered

Learn with daily structure and live support. Each week you’ll receive six concise, prerecorded video lessons released daily. Then join me for a LIVE Q&A on Wednesday at 5:00 PM PST to get your questions answered and lock in your progress.

Can’t attend live? No problem. You’ll be able to post your questions ahead of time and I will address them during the recorded Q&A session—so you’ll never miss the answers you need.

Weekly Rhythm

- Day 1–6: New prerecorded lesson released each day.

- Day 7: Live Q&A with me to review that week’s material.

- Learn at your own pace and stay on track with weekly live support.

By Week 5, You Will Have…

- A fully prepared Titan “Family” or "Personal" Trust,

- A completed Tradename Trust that includes all the assets of the Estate created by your Birth Certificate - with IRS CAF number confirmation,

- Practical tools and guidance to manage both trusts with confidence.

As this is a live launch, topics may be refined based on insights from Q&A sessions.

Built for Real Life

-

Step-by-step guidance for individuals

-

Customization paths for couples

-

Flexible frameworks for families

-

Get access to the proven templates for plug-&-play and easy use!

SEE what's INSIDE THE COURSE…

Detailed video training & fill-in-the-blank templates for building a fortress of Trusts to declare your freedom, claim full title to your estate and protect your assets!

MODULE 1:

THE TITAN TRUST STRATEGY:

A Titan Trust isn't just a Trust! It's a TRUST STRATEGY.

...a Trust Strategy that grants you ALL the benefits of a trust avoiding the negatives (like loss of control). Any good Titan knows that a castle needs many layers of defenses... a strong foundation, sturdy walls, an impassable moat, a hill top advantage, etc. Forget even one protection (like weapons) and the castle can be stormed! The Titan Trust provides those significant layers of defense!

Inside Titan Trust, you won’t just get a list of the defenses required to defend your kingdom, you’ll get step-by-step training walking you through exactly how to NAIL each defense without having to get a law degree!

...so you can rest easy inside your Kingdom!

The “Defenses” of Titan Trust Strategy:

Below is a Sneak-Peak at ALL 16 Required Defenses You’ll Build into Your Titan Trust Strategy:

You’re not just getting the “strategy." I’m giving you everything

you need to design and implement a Trust Strategy For Your Specific Situation!

MODULE 2:

TAILORING A TITAN TRUST

Your trust, your terms—tailored for strength & sovereignty.

Give your trust full legal strength. Build the framework that secures assets, defines legacy and empowers you to protect and manage with confidence.

Transform your documents into a fortress that protects your freedom and your future.

you'll Implement...

- A Strategic Trust Name & EIN

Establish the legal identity that anchors your trust. - Your Personal or Family Trust Founding Document

Create the foundational document that establishes your trust’s structure and power. - Schedule A - For Assets

Establish the framework that both protects and preserves your assets and safeguard what you’ve built by formally placing it under trust protection. - Schedule B - Beneficiaries

Establish a clear framework for your trust’s beneficiaries and protect your loved ones by securing their rightful place in your legacy. - A Trust Bank Account

Establish the banking foundation that brings your trust strategy to life and secure its financial footing to protect and provide for your loved ones.

...AND MORE!

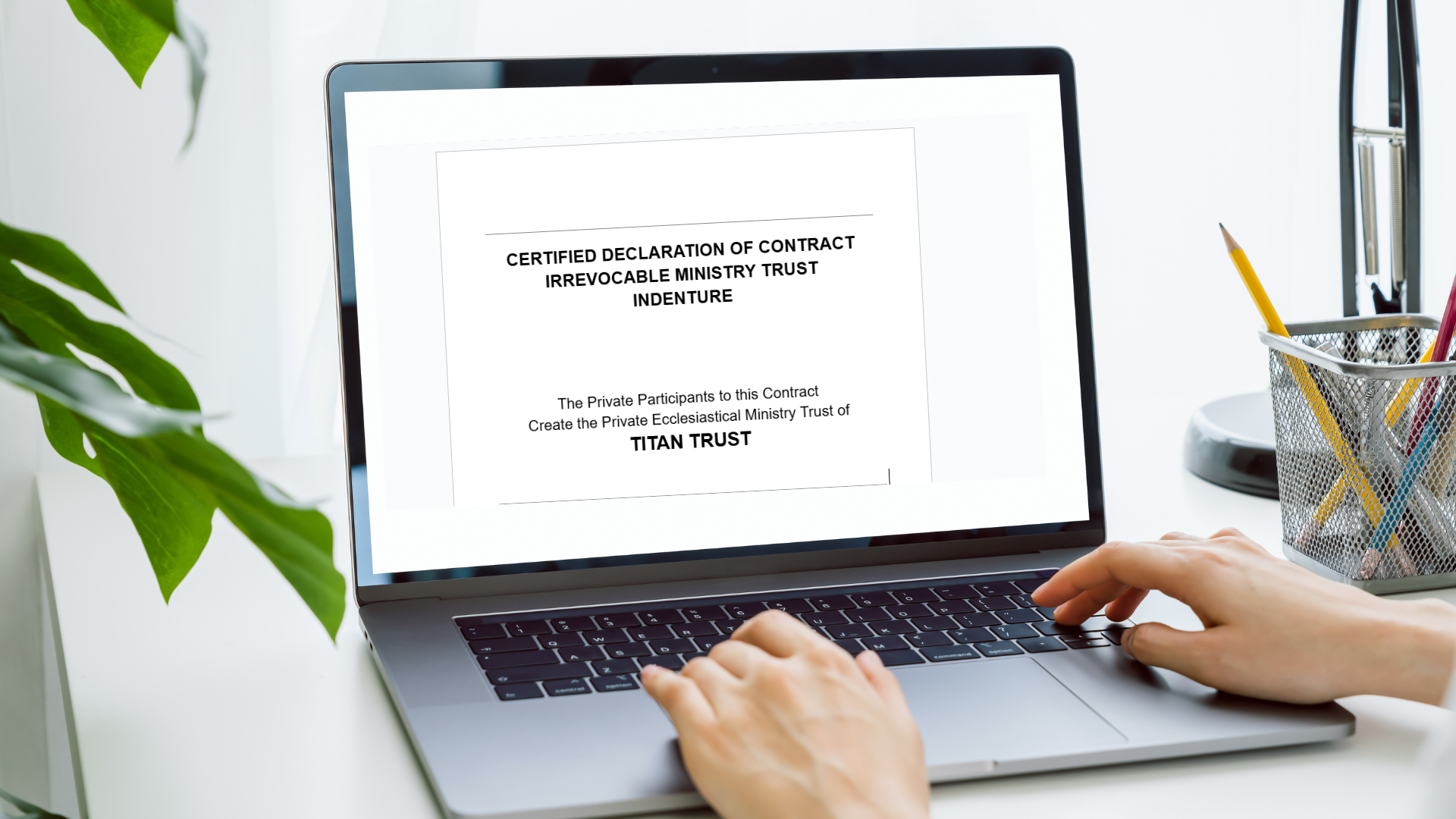

MODULE 3:

TRADE NAME TRUST

Correct the record, reclaim your estate and secure your CAF#.

This is the turning point—the moment you reclaim control of the identity the state created for you at birth.

In Module 3 you’ll learn how to claim your decedent estate under IRS IRM 21.7.13.3.2.2(2) and establish a Trade Name Trust that restores your legal sovereignty.

Step by step you’ll secure the founding documents, schedules, affidavits, and federal forms that correct the record, place your estate under your authority and lock in recognition with both the IRS and the Social Security Administration. From obtaining a Trust EIN and filing Form 56, to registering your CAF number and establishing a dedicated Trade Name Trust bank account—you’ll be armed with the tools to operate with clarity, compliance, and control.

By the end of this module, your Trade Name Trust will stand as a private legal entity—separate, distinct and fully under your direction. No longer tied down by misapplied designations or bureaucratic errors, you’ll walk away with the documents, filings and framework that protect your estate and secure your rightful standing.

The STATE has operated under the presumption of your legal death—claiming your estate in your absence. This module shatters that presumption, proves you are alive and re-vests title back under your authority. By correcting the record, you not only reclaim your estate but also trigger the IRS to assign your CAF#; thus formally recognizing you as the living principal with power over your Trade Name Trust.

Inside MOdule 3, I walk you through...

- Reclaiming your estate by proving you are alive in law and overturning the presumption of death the STATE relies on to control your assets.

- Establishing your Trade Name Trust with its own name, EIN, founding document and schedules—creating a distinct, private, legal entity under your command.

- Correcting the public record with the IRS and Social Security Administration, filing the proper forms and securing recognition of your authority.

- Triggering assignment of your IRS CAF# —formal proof that the federal system acknowledges you as the living principal; not the presumed decedent.

- Plus! Get access to pre-made templates for plug-&-play documents!

MODULE 4:

TRUSTEE TOOLS

From assets to operations—run your trust with confidence & control.

This is where your trust moves from structure to strength—where theory becomes real-world practice. In Module 4, you’ll master the tools every trustee needs to operate with confidence, authority and control.

You’ll learn how to title assets into your trust, make amendments as life evolves and even run a business within your trust framework. From paying employees and establishing a professional fee schedule to handling day-to-day operations, you’ll gain the skills to manage your trust as a living, breathing, legal entity.

By the end of this module, you won’t just understand the responsibilities of a trustee—you’ll be equipped with the tools to enforce them; ensuring your trust is not only established but fully functional, profitable and protected.

From assets to operations—run your trust with confidence and control.

Why the Titan Trust Course Is Worth Far More Than $12,000!

When people hear the word “trust,” they often think of expensive law firms, offshore setups and cookie-cutter “bulletproof” asset protection packages that come with sky-high fees. It’s not uncommon to pay $12,000 to $25,000 up front just to have an attorney assemble one of these trusts—and that’s before you factor in thousands of dollars every single year in ongoing maintenance and compliance costs.

And what do you get for that investment? A trust that may shield assets from creditors or lawsuits—but does nothing to address the root legal presumption the State uses to control your estate.

Here’s the truth: Almost all of those expensive structures leave a glaring gap. They ignore the fact that, in law, your legal identity is treated under the presumption of death. According to centuries-old precedent, if a person is “absent” for seven years, the State acts as the reversioner—it steps in, assumes ownership and profits from the estate as if you no longer exist. The estate tied to your birth certificate and Social Security record is already being managed as if you are legally absent.

That’s why offshore trusts and “bulletproof” strategies, while costly, never deliver the full freedom their sellers promise. They protect assets at the surface but they never reclaim the estate itself.

The Titan Trust Strategy is different.

You gain permanent control over your estate and trade-name — knowledge no lawyer or offshore firm will ever hand you.

And you never pay a maintenance fee.

In this course, you don’t just set up a private ecclesiastical ministry trust along with a trade name trust—you directly confront and correct the presumption of death. You file the affidavits and documents that prove you are alive, present and the rightful principal of your estate. You then assert your claim through the IRS resulting in the assignment of a CAF number—the official recognition that you, not the State, control the estate attached to your tradename.

That single correction alone—the reclamation of your estate and the CAF assignment—is something no offshore lawyer or “asset protection guru” will even touch. They can’t. They don’t have the framework, the authority or the strategy to deal with the underlying presumption. They’ll gladly take your $12,000+ to build walls around your assets, while the State quietly retains the deed to the land beneath your feet.

The Titan Trust Course changes that dynamic forever. For a fraction of the cost, you are not just protecting what you have—you are revesting title, reclaiming your identity and cutting the State out as reversioner. You walk away not only with trusts that rival the strength of offshore structures, but with a living legal status that restores your rightful authority.

And the best part? Once you learn this framework, you don’t pay endless maintenance fees to lawyers or foreign trustees. You hold the knowledge, the documents and the power in your own hands. That makes the Titan Trust Course worth well over $12,000 in real value—without the drain, without the middlemen and without leaving the State’s presumption unchallenged.

This is more than asset protection. The Titan Trust is estate reclamation, identity correction and the restoration of your rightful authority—all for a fraction of what others charge for incomplete solutions.

WHAT'S INCLUDE IN THE PLATINUM PACKAGE?

Every Detail, Every Document – Done for You

Fast-Action Bonuses (before 8/31):

-

🎁 Free 60-minute private strategy session ($400 value)

-

🎁 Extended support – 60 days of email Q&A after delivery (so you’re covered even if IRS responses take longer)

Skip the paperwork headaches and let my team and I set up your Titan Trust for you. Every detail handled-every document prepared-every form filed. You’ll walk away with a fully implemented Titan Trust strategy without lifting a finger.

Everything in the DIY Course PLUS:

-

🏰 We build your Titan Trust + Trade Name Trust for you – designed for a single person or a couple.

-

📜 Founding Documents, Schedules A & B, EIN applications – all fully prepared and customized for you.

-

✒️ Complete Document Packet Mailed to You – this includes:

-

Trust founding documents,

-

IRS Forms 56 & 2848,

-

Affidavit of Non-Decedent Age of Majority,

-

Trust Fee Schedule.

You’ll receive 2 copies of everything along with clear signing/notary instructions and a prepaid return envelope.

-

-

📩 Once you sign and return your packet, we:

-

Submit the finalized IRS forms on your behalf,

-

Record your Trust Fee Schedule with the Pima County Recorder’s Office and mail back your official file-stamped copy.

-

-

🎯 Personal handover session – ensuring you know exactly how to operate and maintain your trusts moving forward.

✅ Best for busy professionals, couples, and families who want their trusts professionally built, submitted and recorded—without the stress or guesswork.

After that, no new DFY enrollments will be accepted until after October 5th. If you miss this window, you’ll need to join the waiting list for the next round.

👉 This option is perfect if you’re serious about protecting your legacy and want it done right, done fast and done for you.

"BECKY! You Made FILLING OUT IRS FROMS - STUPID EASY!

Prior to this, I thought of the IRS as the "big, bad wolf" but the way you explain the process is so logical and made me see that the IRS is just following TRUST law and their manual! When you know the rules of the game you can finally play to WIN!

TITAN TRUST - PRE LAUNCH PARTICIPANT

BONUS #1

Sales Tax Exemption

VALUE

As a 508(c)(1)(A) ecclesiastical entity operating through your trust, you are entitled to sales tax exemption with major vendors like Amazon, Costco, office suppliers and more.

This isn’t theory—it’s recognized status. Once in place, your trust purchases can be exempt from sales tax, allowing you to save real money on everyday transactions and major expenses alike.

Over time, this bonus can amount to hundreds or even thousands of dollars in savings each year—a benefit most people never realize is available. In this course, I’ll show you exactly how to claim it and put it to work.

It’s one more way your trust stops being just a document and starts functioning as a powerful financial strategy in daily life.

-

The average U.S. sales tax rate is about 6–8% (depending on state).

-

If someone spends $2,000–$3,000/year through Amazon, Costco, office supplies, etc., they’d save $120–$240/year just on that.

-

If they spend $10,000–$20,000/year (easy for families or businesses), that’s $800–$1,600/year saved.

-

And this exemption is for your lifetime — not just a one-time perk.

This alone can save you hundreds to thousands of dollars every single year—more than covering the cost of this course.

VALUE

BONUS #2

Property Tax Exemption

Over a lifetime, this bonus alone could be worth tens of thousands in savings.

-

The average U.S. property tax rate is about 1% of property value per year (varies by state).

-

On a $250,000 home, that’s about $2,500/year.

-

On a $500,000 home, that’s about $5,000/year.

-

Over 10 years, the savings could easily exceed $25,000–$50,000 (and that’swhile still paying your mortgage).

-

Over a lifetime, this could be worth well into six figures.

Property Tax Freedom

Imagine owning your home or land without the crushing weight of yearly property taxes—even if you’re still paying on a mortgage. As a 508(c)(1)(A) ecclesiastical entity operating through your trust, you may qualify for property tax exemption, eliminating one of the biggest ongoing expenses most people never escape.

This isn’t a loophole. It’s a recognized, lawful status that churches, ministries and ecclesiastical entities have leveraged for generations. Now, through the Titan Trust framework, you’ll see how to apply the same protections to your own property—whether your title is free and clear or still under mortgage.

The results can be transformative: thousands of dollars in yearly savings that continue for as long as you own your home or land. Beyond the savings, this exemption safeguards your estate, strengthens your trust’s financial foundation and ensures your property is secured for generations to come.

Bonus #2 shows you how to legally eliminate property tax obligations—even with a mortgage—so you can protect your estate while keeping more of your wealth where it belongs; in your trust.

BONUS #3

Defending Your Tradename Trust In Court - Motion to Intervene

VALUE

A Trade Name trust is only as strong as your ability to defend it. That’s why this bonus is priceless! You’ll receive a ready-to-use Motion to Intervene, crafted to assert your rights when your trade name trust is improperly targeted in court.

This isn’t theory—it’s a tested legal document grounded in statutes which establish that only the trustee can defend or act for trust property. With this motion, you can demonstrate to the court that your trade-name is a trust-owned legal person; not a suable party, and force recognition that any claim must be brought against the trustee—not the name itself.

Inside the sample, you’ll see how to:

-

Assert that your trade-name is held as trust property,

-

Challenge jurisdictional defects when a plaintiff fails to name the trustee,

-

Protect yourself from liability while keeping the trust shield intact,

-

Seek relief, damages and dismissal when your trust is wrongly named.

Most people spend thousands in legal fees just to have an attorney draft a single pleading like this. Here, you’ll not only have the sample motion in your hands; you’ll also understand how and why it works. That means you’re never left helpless if your trade-name trust is attacked.

With Bonus #3, you gain the confidence of knowing that if the State, a bank or any third party tries to drag your trade-name into court, you have the legal framework to intervene, defend and prevail.

This is your shield in writing—ready when you need it.

This ready-to-use motion gives you the ability to defend your trade-name trust in court without paying thousands to an attorney. Built on statutes like NRS 163.070 and NRCP 24, it shows the court that your trade-name is a trust asset; not a suable party—forcing recognition of your authority as trustee and protecting you from liability.

-

A lawyer drafting a single motion like this (especially an intervention with declaratory relief + damages requests) can easily cost $2,500–$5,000.

-

If you retain counsel for ongoing litigation, you’re looking at $300–$600/hour with total fees often $10,000+ per case.

-

Having a tested sample that you can adapt, plus the knowledge of how to use it, eliminates thousands in legal costs and gives you immediate defense capability.

Legal Defense Blueprint

VALUE

BONUS #4

Enforcing Your TRUSTEE STATUS

without going to court

The strongest position you can hold as a trustee is one where you never even need to step foot in a courtroom. Bonus #4 equips you with proactive strategies to assert and enforce your trustee status early; stopping overreach before it escalates into costly litigation.

Inside, you’ll discover how to use professional cease-and-desist notices and invoicing strategies to protect your trust and tradename against unlawful claims, demands or intrusions. These tools allow you to document violations, put third parties on notice and establish a paper trail that shows you exercised due diligence long before any legal proceeding.

Instead of reacting after your trust is attacked, you’ll learn how to take the offensive—standing firm, asserting your rights and compelling recognition of your trustee authority without court intervention.

Most trustees never see these strategies because lawyers are trained to fight only once you’re already in court. This bonus flips that model on its head-giving you the means to prevent disputes, cut off attacks at the root and preserve the integrity of your trust from the start.

Bonus #4 makes you proactive; not reactive—empowered to enforce your authority and shield your trust with confidence.

“There, every man is independent of all laws, except those prescribed by nature. He is not bound by any institutions formed by his fellowmen without his consent.” ”

— Cruden v. Neale, 2 N.C. 338 (1796) 2 S.E.

2 Payments: $1,094

$547 each

(Enroll by August 31, 2025, 9 PM PST, for 50% off )

2nd payment will be in 30 days

PAY IN FULL: $1,997 $997

(Enroll by August 31, 2025, 9 PM PST, for $1,000 off )

Save $191 When You Pay in Full!

Platinum Package:

$7,997

(From Blueprint to Binding Documents – Done for You)

Only 3 Spots Available *

Let’s Address

the Elephant in the Room!

Yes — your Estate has value. Real, measurable value. And for generations, the State has been “managing” our Estates under the legal presumption that we are dead.

That’s not theory. That’s the cold reality laid out in the IRS Manual.

Now, here’s the part most people dance around: This course does not teach you how to directly access and draw down the financial value of that Estate… yet. That process is still being developed and tested. And when the door finally swings open, it will require groundwork that 99% of people simply won’t have in place.

That’s why the Titan Trust Strategy is so powerful.

Even without touching the Estate funds, you gain:

-

A fortress trust structure that protects your assets and loved ones right now,

-

A framework that establishes you as alive, active and in command of your Trade Name,

-

The legal positioning to claim what’s yours when the “hidden key” finally turns.

Think about it. By implementing this today, you’re not just reclaiming freedom and protection in the present; you’re laying the foundation for the moment that locked-away value becomes accessible.

And let’s be honest…that moment may come sooner than anyone expects.

So here’s the decision:

Do you wait, unprotected and unprepared, hoping the secret unlocks while you’re still presumed dead?

Or do you step into Trustee status now, build your Titan Trust and ensure you’re ready the second the opportunity arrives?

With Titan Trust, you’re not left behind—you’re first in line.

In CASE There's Anything I Missed, Here are SoME Commonly Asked Questions!

When does the course start?

What if I can’t attend the live Q&A?

How long will I have access to the course?

What do I need to prepare before the course begins?

How much time should I set aside each week?

Is this course live or self-paced?

Will this course help me access the financial value of my Estate?

Is this course only for families?

Do I need prior legal or financial knowledge?

Are there any extra costs beyond the course tuition?

How will my privacy be protected during the course?

I don’t have a lot of assets right now—does this course still make sense for me?

If I don’t like the course, can I get a refund?

What if I need help during the course?

2 Payments: $1,094

$547 each

(Enroll by August 31, 2025, 9 PM PST, for 50% off )

2nd payment will be in 30 days

PAY IN FULL: $1,997 $997

(Enroll by August 31, 2025, 9 PM PST, for $1,000 off )

Save $191 When You Pay in Full!

Platinum Package:

$7,997

(From Blueprint to Binding Documents – Done for You)

Only 3 Spots Available *

“All codes, rules and regulations are applicable to the government authorities only, not human/Creators in accordance with God's laws. All codes, rules and regulations are unconstitutional and lacking in due process …”

— Rodriques v Ray Donavan (U.S. Department of Labor), 769 F. 2d 1344, 1348 (1985).

⚖️ Full Disclosure & Terms & Conditions

Educational Purpose Only

The Titan Trust Course, including both DIY and Done-For-You (“DFY”) options, is provided for educational and informational purposes only. Nothing in this course, its materials or any related communication should be construed as legal, financial or tax advice. Becky Nevin is not acting as your attorney, accountant or licensed financial advisor. You are encouraged to seek qualified professional advice regarding your specific situation.

Results Disclaimer

Every individual’s circumstances are unique. While the strategies taught are designed to help you establish, operate and defend a trust structure, no specific financial, legal or administrative outcome is guaranteed. The course does not claim to provide direct access to estate assets presumed managed by the State. That process remains under development. While your groundwork is prepared here, no guarantee of timing or access is promised.

Privacy & Data Handling

-

DIY participants: You retain all responsibility for completing and safeguarding your documents.

-

DFY participants: Certain personal documents (such as your Long Form Birth Certificate, SS Card, ID, and signed/notarized affidavits) must be submitted securely via the course portal or email. All reasonable efforts will be taken to protect your private information; however, you acknowledge that transmission via electronic or physical mail carries inherent risks.

Refund Policy

-

DIY Course: All sales are final. Once you have access to the materials, no refunds will be issued.

-

DFY Service: Due to the personalized nature of drafting and filing, no refunds are provided once document preparation has begun.

Delivery & Support

-

DIY Course: Includes access to prerecorded lessons, weekly Q&A sessions (live and recorded) and the course portal.

-

DFY Service: Includes a strategy session, drafting and mailing of trust documents, prepaid return envelopes and extended support for 60 days after delivery. DFY turnaround is guaranteed by October 3, 2025 if enrolled by August 31, 2025. Late enrollments may be placed on a waiting list.

Additional Costs

You are responsible for third-party costs such as notary services, mailing, faxing or government filing fees. These are not included in your course or DFY purchase price.

Limitation of Liability

By enrolling, you agree that neither Becky Nevin nor Titan Trust shall be held liable for any direct, indirect or incidental damages arising from your use of the information or services provided. You assume full responsibility for your decisions, filings and results.

Commitment

I am committed to providing the most accurate, actionable and practical training possible. While no guarantees can be made, our promise is to deliver tools, templates and strategies designed to give you clarity, confidence and structure in reclaiming your trust rights.